How to Create a Personal Budget Easily and Effectively

Creating a personal budget is an important step toward achieving financial stability and planning for a better future. A well-prepared budget helps you manage your income and expenses more wisely, avoid overspending, and maximize savings and investments. Here’s how to create a personal budget easily and effectively.

1. Assess Your Income

The first step in creating a budget is understanding how much income you receive each month. This income can come from salary, side businesses, investments, or other sources of income. Be sure to record your total income in detail, including any bonuses or allowances that might not come every month but should still be considered in your yearly budget.

2. Make a List of Your Expenses

After understanding your income, the next step is to list your expenses. Expenses can be divided into two main categories:

- Fixed Expenses: Expenses that are consistent every month, such as mortgage payments, utilities, internet subscriptions, and insurance premiums.

- Variable Expenses: Expenses that can change each month, such as food, transportation, entertainment, shopping, and other needs.

Be honest when recording all of these expenses, and pay attention to areas where you can cut back or eliminate unnecessary spending to save money.

3. Set Financial Goals

Every effective budget should be based on clear financial goals. These goals can include saving for an emergency fund, buying a house, funding your children's education, retirement, or a vacation. Setting these goals will help you prioritize your spending and saving.

Examples of financial goals:

- Save for an emergency fund: 6 months' worth of expenses

- Save for a family vacation

- Invest for retirement

4. Create a Spending Plan

Based on the list of your expenses and financial goals, you can start creating a monthly budget plan. Be sure to allocate your income to several spending categories, such as:

- 50% for necessities: The largest portion goes toward daily expenses such as food, housing, transportation, and fixed bills.

- 30% for savings and investments: A portion of your income should be allocated for savings and investments to meet your financial goals. This could include an emergency fund, stock investments, or a retirement account.

- 20% for entertainment and lifestyle: This portion is for discretionary spending, such as dining out, shopping, and other activities that improve your quality of life.

This allocation helps ensure that your budget covers all important aspects without neglecting savings or personal expenses.

5. Use the 50/30/20 Rule

The 50/30/20 rule is a simple approach to budgeting that can help you structure your finances easily and effectively. In this method, your income is divided as follows:

- 50% for essentials (basic needs like food, housing, transportation, etc.).

- 30% for wants (entertainment, lifestyle, subscriptions, dining out, etc.).

- 20% for savings and debt repayment (emergency fund, investments, debt payments, etc.).

By following this rule, you can maintain a balance between spending and saving without feeling overly restricted in your lifestyle.

6. Monitor and Adjust Your Budget

Creating a budget is an important first step, but it’s equally important to monitor and adjust it regularly. Be sure to review your expenses each month and compare them to your budget. If any category exceeds the budget, find ways to reduce spending in that area in the following months.

If your financial situation changes (such as an increase or decrease in income) or if your financial goals are met, you can adjust your budget accordingly to make sure it remains realistic and relevant to your current circumstances.

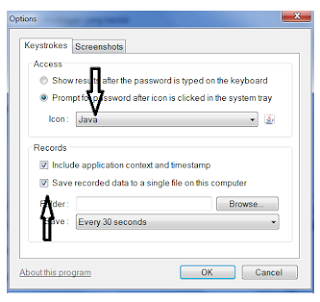

7. Use Financial Apps or Tools

There are many financial apps available to help you monitor your budget and expenses easily. Some apps allow you to categorize your spending, track your bank balances, and generate monthly financial reports. These apps can help you stay disciplined in managing your budget and achieving your financial goals.

8. Maintain Commitment and Discipline

Creating an effective budget will not yield maximum results if you are not disciplined in following it. Staying committed to the budget you’ve created and avoiding unnecessary expenses is key to successfully managing your personal finances.

Conclusion

Creating a personal budget doesn’t have to be complicated. By understanding your income, listing your expenses, setting financial goals, and allocating your funds wisely, you can manage your finances better. Remember, the key to a successful budget is discipline and consistency. With a good budget in place, you can achieve your financial goals and enjoy a more stable financial future.

Comments

Post a Comment